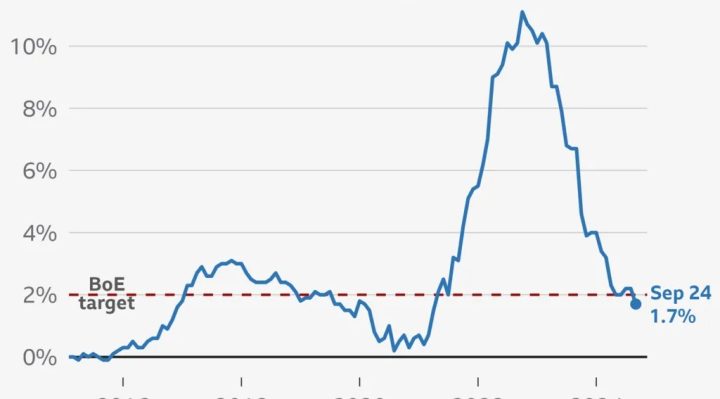

UK inflation has unexpectedly dropped to 1.7% for the year ending in September, marking the lowest rate seen in over three years.

The decrease has been largely attributed to reduced airfares and lower petrol prices, according to official data.

This decline brings inflation below the Bank of England’s target of 2%, potentially opening the door for further interest rate cuts next month.

The inflation figure for September typically informs adjustments to various benefits, including Universal Credit, which are set to take effect in April.

This adjustment also encompasses key disability benefits such as Personal Independence Payment, Attendance Allowance, and Disability Living Allowance, as well as Carer’s Allowance.

However, the projected 1.7% increase in benefits falls short of the anticipated 4.1% rise in the state pension, which is determined by the triple lock mechanism.

The Office for National Statistics (ONS) reported that petrol and diesel prices saw a significant drop, falling by 10.4% in September compared to the same month last year.

In addition, the cost of fares for domestic, European, and long-haul flights contributed to the decrease in the inflation rate. While it is common for fares to decrease after the summer travel peak, the decline this year was more pronounced.

Conversely, households faced a rise in food and non-alcoholic beverage prices, with notable increases in the costs of milk, cheese, eggs, soft drinks, and fruit.

Darren Jones, Chief Secretary to the Treasury, stated that the slowdown in price increases would be “welcome news for millions of families.”

“Nevertheless, we still have work to do to support working people, which is why our focus is on reviving growth and restoring economic stability to fulfill the promise of change,” he emphasized.

This unexpected drop in the UK’s inflation rate comes ahead of this month’s Budget, as Chancellor Rachel Reeves prepares to implement tax increases and spending cuts totaling £40 billion.

Reeves, who is finalizing her first Budget scheduled for October 30, cautioned ministers that there will be “difficult decisions on spending, welfare, and tax.”

She is crafting plans to secure £40 billion to prevent real-terms cuts to government departments.

Interest Rate Cuts Anticipated in November

With inflation falling below many economists’ forecasts, markets have begun to bet heavily on an interest rate cut when the Bank of England convenes in November, according to Susannah Streeter, head of money and markets at Hargreaves Lansdown.

“A quarter percentage point cut seems almost certain, and expectations for a second rate cut in December have also risen significantly,” added Danni Hewson, head of financial analysis.

Current UK interest rates stand at 5%. The Bank had been steadily raising rates since late 2021 in response to rising inflation, driven in part by surging energy prices following Russia’s invasion of Ukraine.

After making its first cut in August, the Bank chose to maintain the current rate last month. However, Yael Selfin, chief economist at KPMG UK, indicated that the drop in September’s inflation rate would likely prompt policymakers to consider further reductions.

She cautioned, however, that inflation may rise again as household energy bills are set to increase by approximately 10% this month.